Opening an Opay account is the easiest thing to do in Nigeria. There are many financial institutions in Nigeria, but there is one that many people rely on to make fast transactions without any delay.

The dream of many individuals, businesses, and organizations is to make reliable and secure transactions online without any hindrance. Opay seems to be the financial institution many traders trust for their business transactions.

If you have been looking for how to open an Opay account, you have come to the right place. In this article, we will show you how to open an Opay account, the requirements needed, and how to fund your Opay wallet.

What is Opay?

Opay is a Nigerian financial technology business operating in other African countries. The company offers many services, including mobile payments, ride-hailing, food delivery, and others.

Get TikTok SEO Cheat here

Opay began in 2018 in Lagos state and has since spread across the remaining states in Nigeria. It was launched by Opera Software, which owns the famous Opera browser.

The platform was initially designed to make it easier for Nigerians to make payments and send money using their mobile devices. However, Opay’s services have now extended to encompass additional financial products, as well as transportation and food delivery services.

Opay has grown in popularity in Nigeria as a result of its ease of use, low costs, and diverse variety of services. Many POS agents use the platform. The platform has also aided in improving financial inclusion in the country by allowing people who previously did not have access to financial services to do so.

Before diving into how to open an Opay account, let’s show you what you need.

The Requirements To Open An Opay Account

You will need the following to open an Opay account:

- A mobile device: To use the Opay platform, you will need a smartphone with internet connectivity.

- A registered phone number: You must supply a registered phone number in your name.

- A valid ID: You need a valid ID card such as a national identity card, driver’s license, or international passport.

- A Bank Verification Number: To create any financial account in Nigeria, you will always need a BVN.

- A bank account: you will need to link your Opay account to your bank account in order to make necessary financial transactions in the Opay wallet.

- A profile image: You must post a recent and clear profile picture of yourself.

While not needed, giving an email address will help you regain your account if you need to remember your password or experience any other problems.

How To Open An Account With Opay

Once you have the needed requirements, you can proceed to open an Opay account. You can register for an Opay account via the app or Opay website.

It is usually recommended that you have the app on your phone for easy transaction. This is why we would take you through the step by step methods needed for creating an account on the app.

1. Download The Opay App

You can download the Opay app on Playstore for your Android phone or Apple store for your iPhone. Once you have downloaded the app, click “Open.”

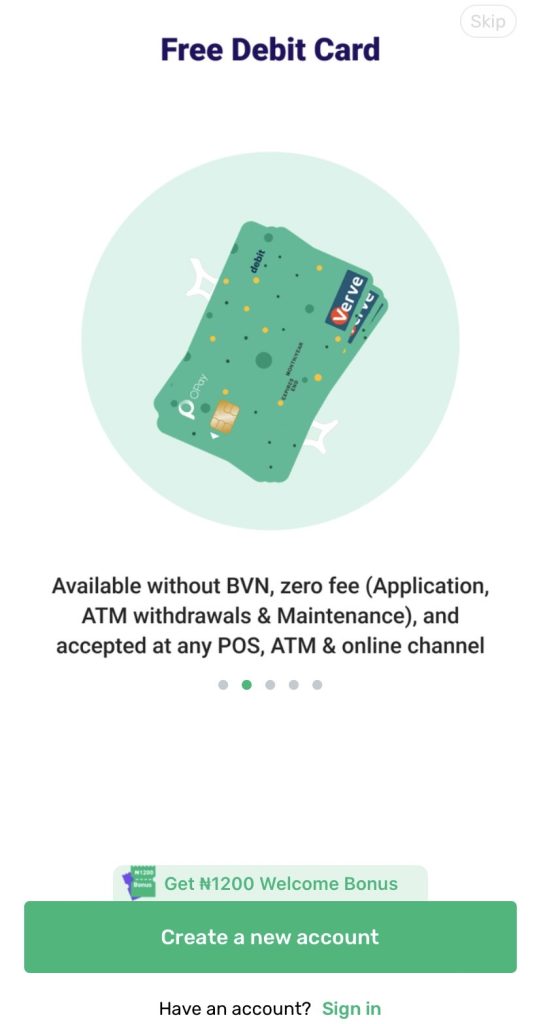

2. Create A New Opay Account

The app is now almost ready for use. You can click on “Create a new account.”

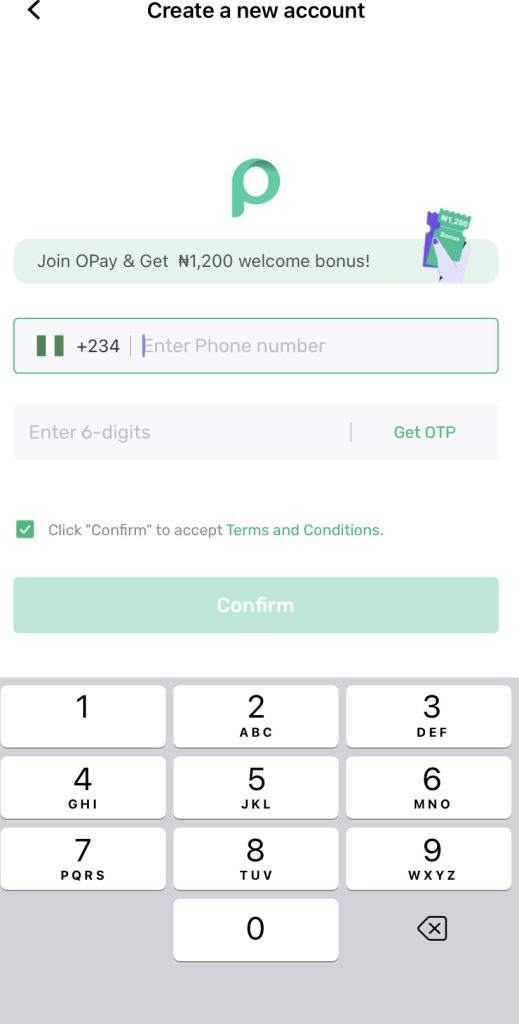

In the next step, you will be asked to input your phone number. Make sure the number you are inputting is registered. An OTP will be sent to your registered number. After you have inputted the OTP, you can tap on confirm to proceed.

The following step is to enter your personal information. You must provide your name, phone number, email address, and establish a password on the Opay registration form.

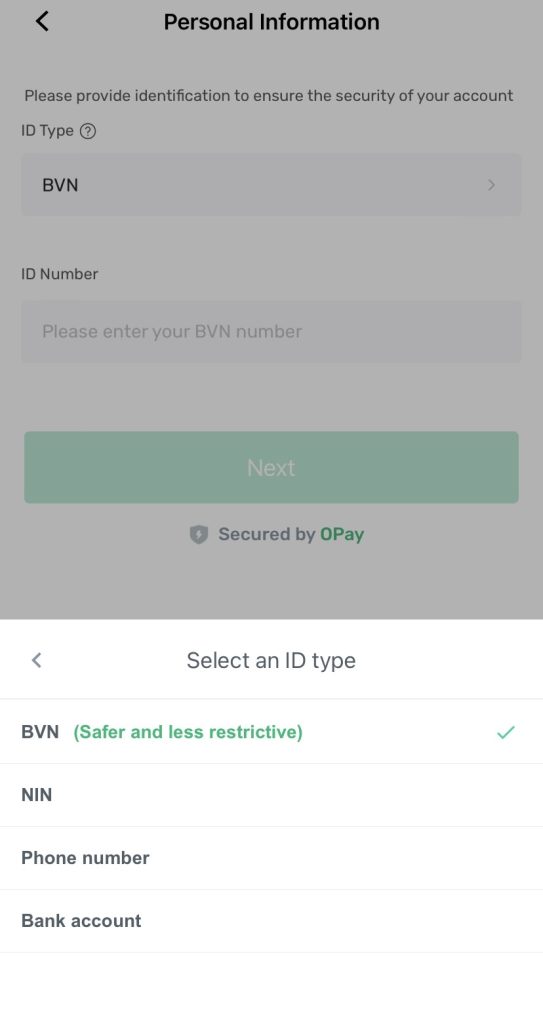

3. Your Personal Information

You will need to provide an identification for your account to make sure you account is secure and safe. You can use either of the following:

- BVN

- NIN

- Phone Number

- Bank Account

Opay recommends using your BVN because it is safer and your account will not be limited.

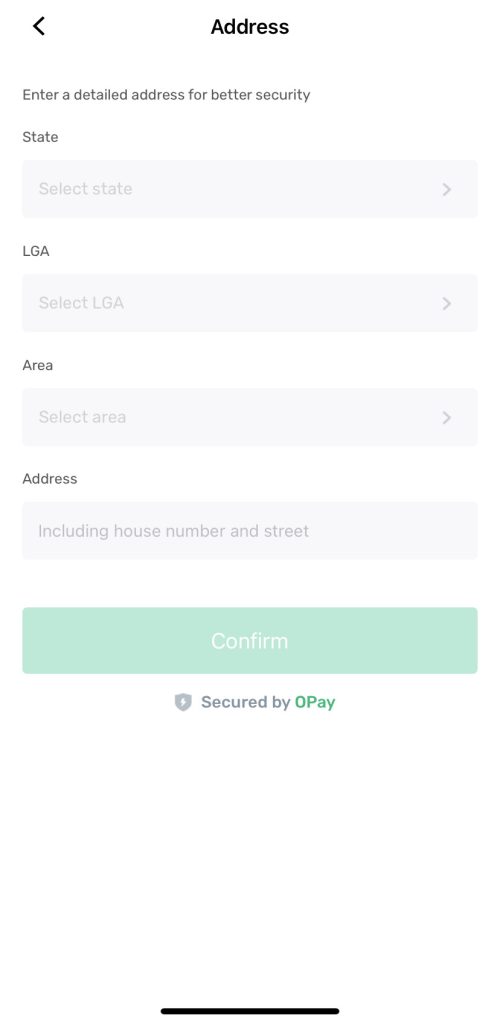

You will also need to give your address. Opay requires your state, LGA, area and house address. Once you have entered the correct information into the following fields, you can proceed by clicking on “confirm.”

You will also be asked to create a six-digit pin. Ensure that the pin you input is one you can easily remember.

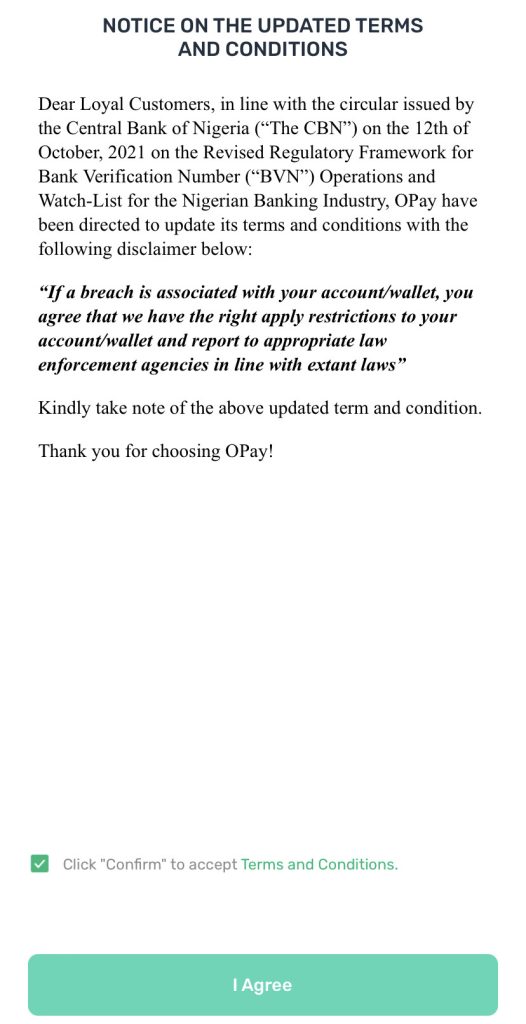

4. Terms And Conditions

Once you have fulfilled all the requirements, you can accept the terms and conditions by ticking the box and clicking on “I Agree.”

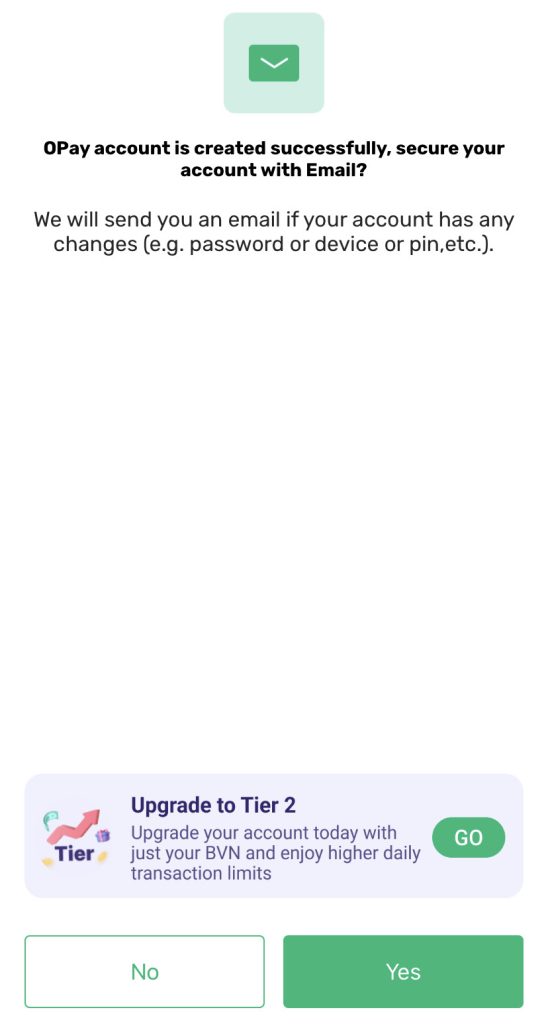

Once done, Opay brings another page to tell you that your account has been created successfully. You can decide to secure your account with your email.

5. Fund Your Opay Wallet

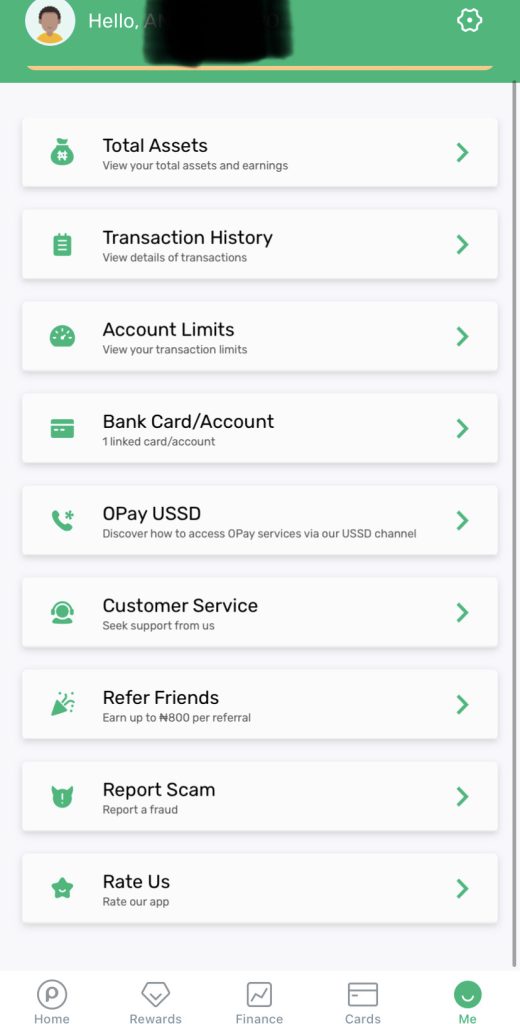

Once you have successfully created your account, you are ready to enjoy the many benefits of having an Opay account.

You can proceed to fund your Opay wallet. To add money to your OPay wallet, go to the OPay app’s homepage and select ‘Add Money.’ This will show you the many alternatives for funding your account. You can currently fund your OPay wallet with the following:

- Bank Transfer

- Top Up

- Opay Deposit

Advantages Of An Opay Account

1. Convenient mobile payments

With an Opay account, you may make payments using your mobile device instead of cash or an actual card. This makes paying for goods and services relatively convenient, even in situations where the currency is not accepted.

2. Low transaction fees

Because Opay charges low transaction fees for its services, it is an economical solution for many customers. Opay also runs promotions and offers discounts to its users, which can help you save money on your transactions.

3. Fast and secure transactions

Opay protects your transactions and personal information with modern security mechanisms. Transactions on the platform are also processed swiftly, so you won’t have to wait long for a transaction to be completed.

4. Easy Financial Services

In addition to mobile payments, including bill payments, airtime recharge, and money transfers. The portal also offers transportation and food delivery, making it a one-stop shop for many everyday requirements.

You can make payments for WAEC, fund cowry cards, government payments and levies, DSTV and GOTV subscriptions, and hotel and flight bookings. You are also at liberty to access loans on Opay called Okash Loan.

How To Put Money Into Your Opay Wallet

You can fund your Opay wallet using any of the methods listed below:

1. Bank Transfer

Using the Opay bank account credentials supplied in the app, you can transfer money from your account to your Opay wallet. The funds will be credited to your Opay wallet when the transfer is complete.

2. A Debit/Credit Card

You can fund your wallet by linking your debit or credit card to your Opay account. To do so, navigate to the app’s “Fund Account” area, select the card option, and then follow the prompts to enter your card information and finish the transaction.

3. Cash Deposits

You can deposit cash into your Opay wallet at any Opay agent or partner bank. Simply provide the agent or bank with your Opay phone number and the amount you want to deposit, and the money will be credited to your wallet.

4. Opay Partner Merchants

You can also fund your Opay wallet by purchasing goods or services from Opay partner merchants. At checkout, simply pick the “Pay with Opay” option, and the cost of your item will be withdrawn from your wallet balance.

Conclusion

OPay is without a doubt one of the several financial platforms and gateway channels dedicated to making payments and subscriptions simple for Nigerians. We hope you found this article helpful. You can share with your family and friend who wish to open Opay accounts.